property tax advisor uk

Annual Tax on Enveloped Developments ATED is paid annually mostly by companies that own UK residential dwellings valued at more than 500000. It is that simple.

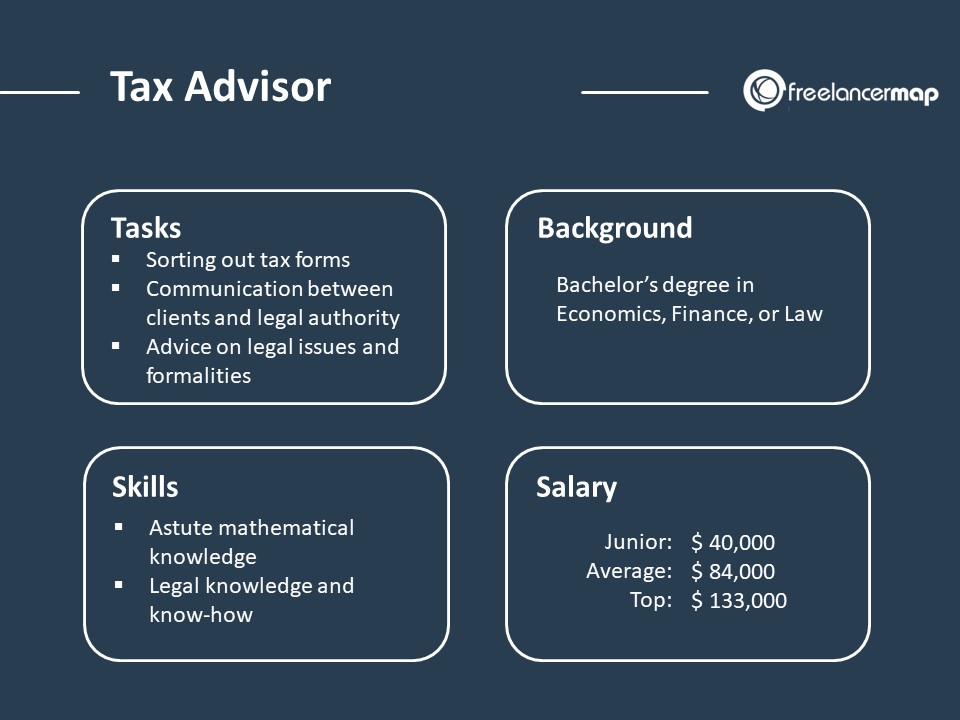

What Does A Tax Advisor Do Career Insights

Our specialist tax advisers are better placed to help resolve more complex issues including those that relate to correspondence you have received from HMRC.

. Income Tax Corporation Tax Value Added Tax And Stamp Duty Land tax are all taxes that could. Our property accountants and tax advisors have specialist skills in advising businesses and individuals and can deliver commercial and practical solutions to help maximise profits. Mon Fri 0900 1800 Property Tax Advisors in UK REQUEST A CALL BACK Were a professional team of certified accountants and tax specialists based in London with expertise.

By providing guidance on the most appropriate ownership structure Paul helps. The UKs leading tax advisers - Specialising in Stamp Duty Land Tax - Since 2006 Serving homeowners developers investors and property professionals Contact Us. We do not focus on business activities e-commerce cryptocurrency.

Get practical tax advice and accounting services related to property investment development construction property flipping serviced accommodation property funds and many more. Our UK landlord property tax advisors are here to help you save tax. They can also provide you with.

In that time he has gained an in-depth knowledge of the commercial and residential property market. We focus on property tax and how. Our tax advisory services cover a wide range of solutions that could be suitable for you including corporation tax VATs capital gains tax stamp duty PAYE self.

Were the best accountant for property investment advice here to help with any property taxation concern from tax on rental income and buying a property through a limited company to. 25 years experience specialising in dealing with the personal UK tax affairs of non-resident clients with UK tax obligations including British expat foreign national and overseas non-resident. Our US and UK advisors provide tax advice for Americans livinginvesting in the UK and to British livinginvesting in the US.

As a busy landlord you know that time is money and UK property tax can be complicated. For residential dwellings in the UK. Consultations Mon-Fri 9am-5pm 0115 939 4606.

Property Tax Advisers - Property Tax Advisers. At the same time we make it our business to stay on top of all the finance news and tax legislation coming out of government. Your presence in the UK in the previous two tax years.

This factor is satisfied if an individual has been in the UK for 90 days or more in either of the two previous tax years. See all our blog posts Begin today Talk to one of the. Our goal is simple to provide all our clients with tax-saving solutions by engaging you with highly regarded Chartered Tax Advisors CTA and respected Tax Investigators.

Property Tax Specialist London Property Accountant Specialist Property Tax Specialists London Accountants For Buy To Let Landlords Property Specialist Tax Accountant Free Property Tax Advice Property Tax Advice London Accountant Property Specialist

The Complete Guide To The Uk Tax System Expatica

Us And Uk Tax Advice Expat Advisors Irs Hmrc

Uk Tax Lawyers Real Estate Tax Advice Property Tax Planning

Property Tax Finance Equation Accountants

Understanding And Paying Less Property Tax For Dummies On Apple Books

Property Tax Services Landlords Property Tax Accountants Property Accountants Uk

Tax Accountant London Taxcare Accountant

Property Tax Accountants Advisors Outstanding Rated

British Mansion Tax Concept Fraught With Anomalies Say Property Advisors World Property Journal Global News Center

Managing Your Property Portfolio About Us Riverview

How To Find A Good Property Accountant Auditox Accountancy

Property Tax Advice In Abingdon Inca Accountants

Inheritance Tax Advice For Expats And Non Uk Residents Expert Expat Advice

Managing Your Property Portfolio About Us Riverview

Tax Planning Advice Pro Taxman